Economic systems aren’t like physical ones; they don’t naturally reach a stable equilibrium.

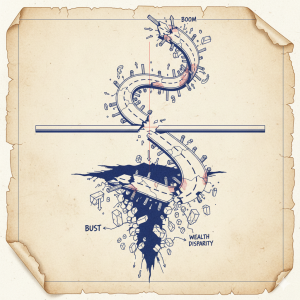

The boom-and-bust cycle and rising wealth disparity aren’t bugs.

They are the undocumented features of a capitalist system, proving it’s not a self-stabilizing system.

Economics Isn’t a Linear System

Most of us learned about supply and demand in school. Price goes up, demand goes down. Price goes down, demand goes up. This simple model works well enough for a quick explanation, but it assumes a predictable, straight-line relationship. The real world isn’t a straight line. It’s full of feedback loops, tipping points, and unexpected chaos.

Most of us learned about supply and demand in school. Price goes up, demand goes down. Price goes down, demand goes up. This simple model works well enough for a quick explanation, but it assumes a predictable, straight-line relationship. The real world isn’t a straight line. It’s full of feedback loops, tipping points, and unexpected chaos.

Think about a pendulum. It swings back and forth, eventually settling in the middle due to friction. That’s a linear, predictable system moving toward equilibrium.

Now, imagine a pendulum that, every time it swings, changes its own weight, or the length of its string. That’s a better analogy for an economy. The actions of one person or group affect the entire system, which in turn affects their actions in a continuous, unpredictable cycle.

The economy is a non-linear human system.

It’s driven by our decisions, emotions, and beliefs, all of the messy human things that don’t follow neat mathematical formulas.

Why It Matters: Boom and Bust

The most obvious example of this non-linearity is the boom-and-bust cycle. If the economy were linear, a downturn would trigger a slow, predictable correction. Instead, we see periods of rapid growth fueled by speculation and irrational exuberance.

When everyone believes a stock, a house, or a cryptocurrency will only go up, they buy more. This pushes the price even higher, reinforcing the belief. It’s a classic positive feedback loop, like a microphone getting too close to a speaker. The system becomes unstable.

Then, for no apparent reason, a small event, a bad news report, a key player selling off; can trigger a massive, cascading collapse. The momentum that drove the boom reverses, leading to a panic-driven sell-off. This isn’t a measured correction; it’s a dramatic, unpredictable crash. The Great Depression and the 2008 financial crisis weren’t slow slides. They were rapid, systemic failures.

The Discrepancy Between Rich and Poor

The rising wealth gap is another symptom of a non-linear system. In a linear model, wealth might disperse evenly over time. But capitalism, left unchecked, tends to concentrate it. Money makes money. The wealthy have access to better investments, political influence, and opportunities that are unavailable to others.

This creates a powerful feedback loop. The rich get richer, and the poor, lacking the same access, fall further behind. It’s not an equilibrium state; it’s a constant, and accelerating, disequilibrium. This is the opposite of a system tending toward balance. It’s a system tending toward polarization.

A System’s True Nature: Not a Bug, but a Feature

The recurring booms, busts, and widening wealth gaps aren’t just unfortunate accidents. They are the natural consequence of a system that is inherently non-linear, human-driven, and unregulated. This isn’t a condemnation of all free markets. It’s a call to understand their true nature. We need to stop viewing economic crises as external events. They are the predictable outcomes of a system that amplifies human greed and fear, not one that naturally self-corrects.

The solution isn’t to force it into a rigid, linear model. It’s to understand its non-linear properties and build systems of regulation, taxation, and social support that can manage and mitigate its destructive tendencies.